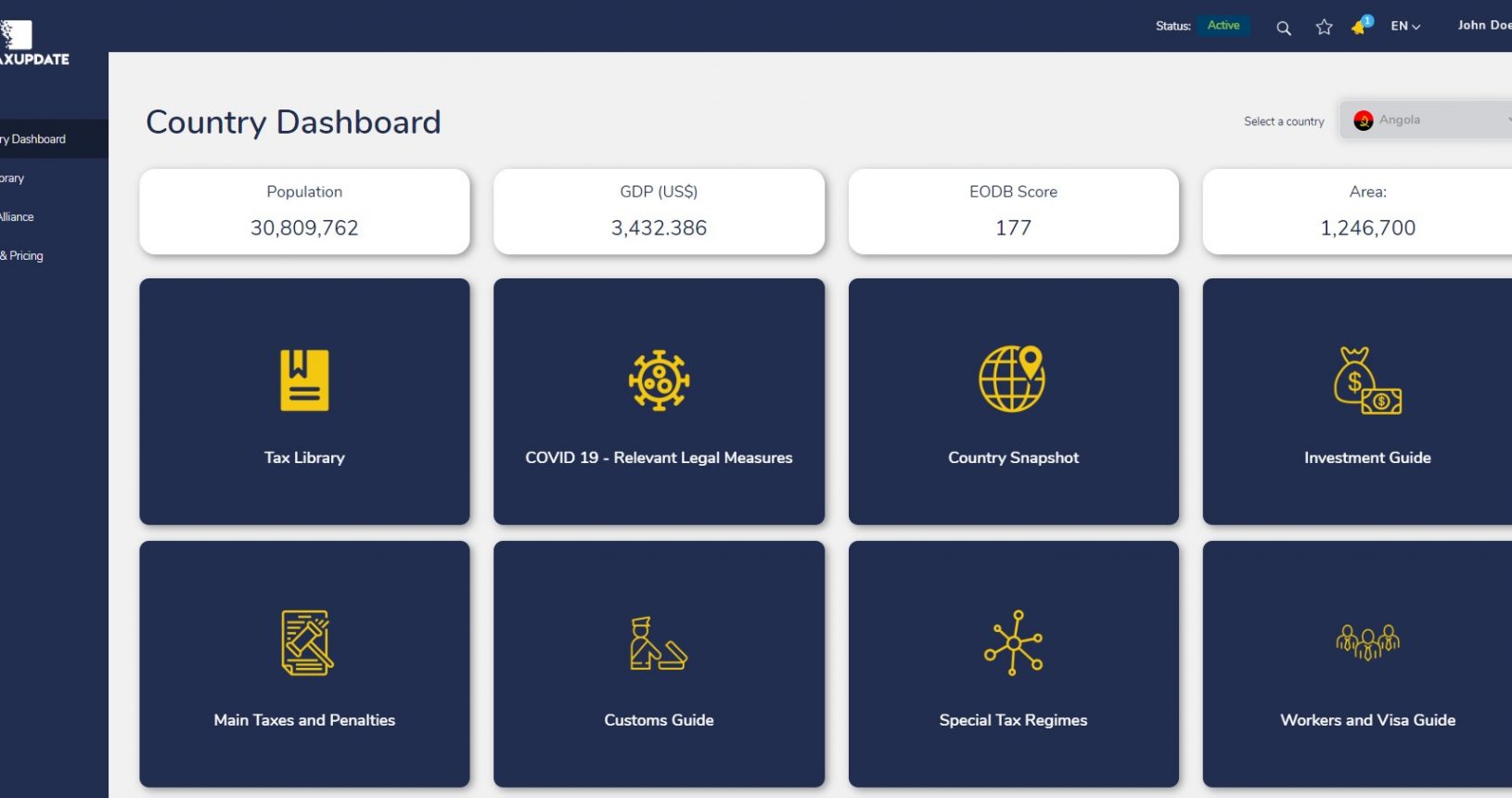

HOW IT WORKS

We cover complex tax markets to provide you with real-time tax legislation updates, country guidelines and other business essentials when negotiating in Africa.

OUR OFFER

STARTING FROM €20 PER MONTH

Make the perfect choice for you! We have 4 options of plans, with 1, 6 or 12-month billing alternatives.

Include add-ons according to your preference.

Acces up to 9 countries

Choose number of Users

Receive Daily Tax Updates via email

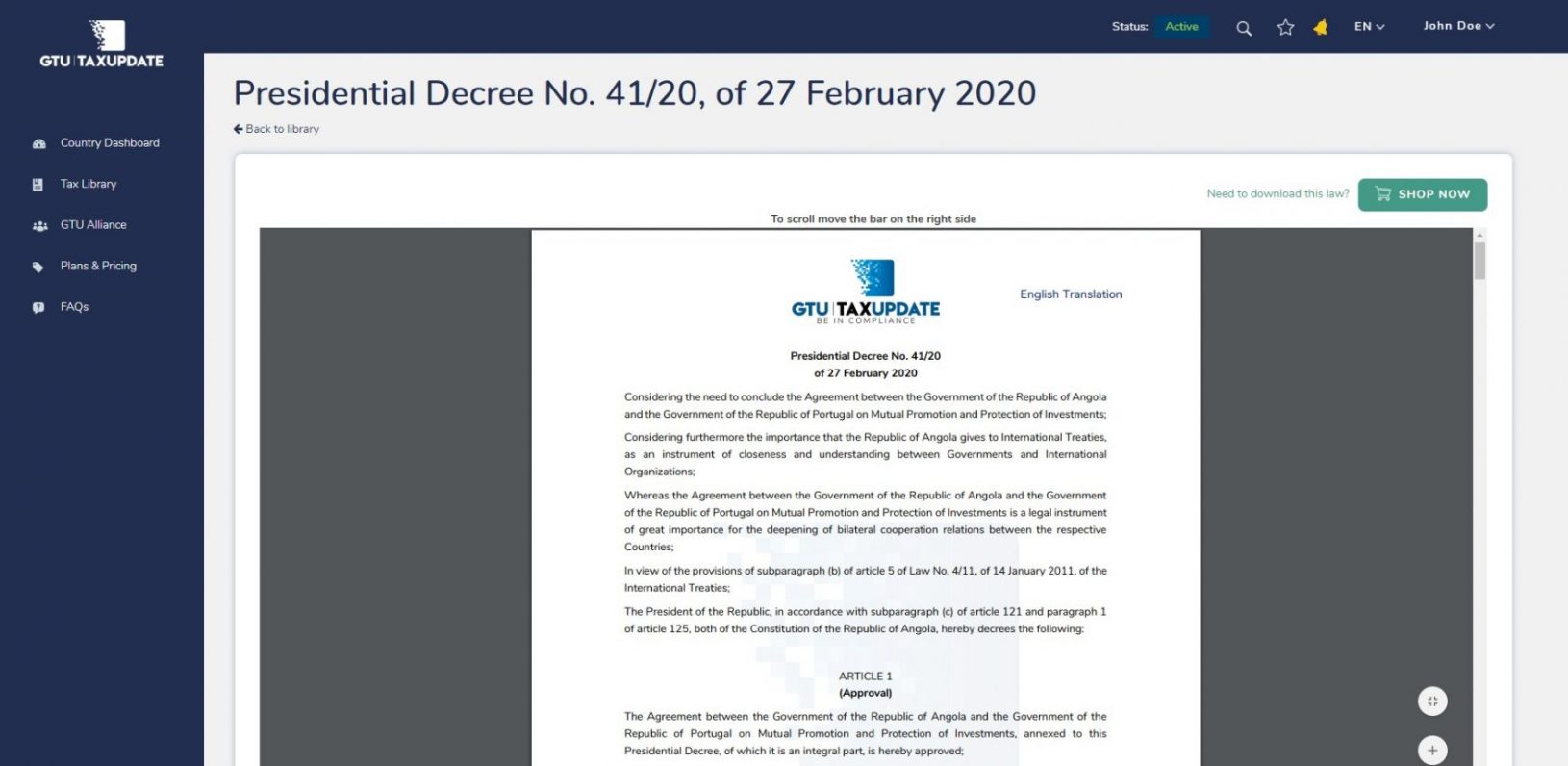

Access Documents from Original Sources

English Translation of Main Legal Statutes

Dowload Original Documents

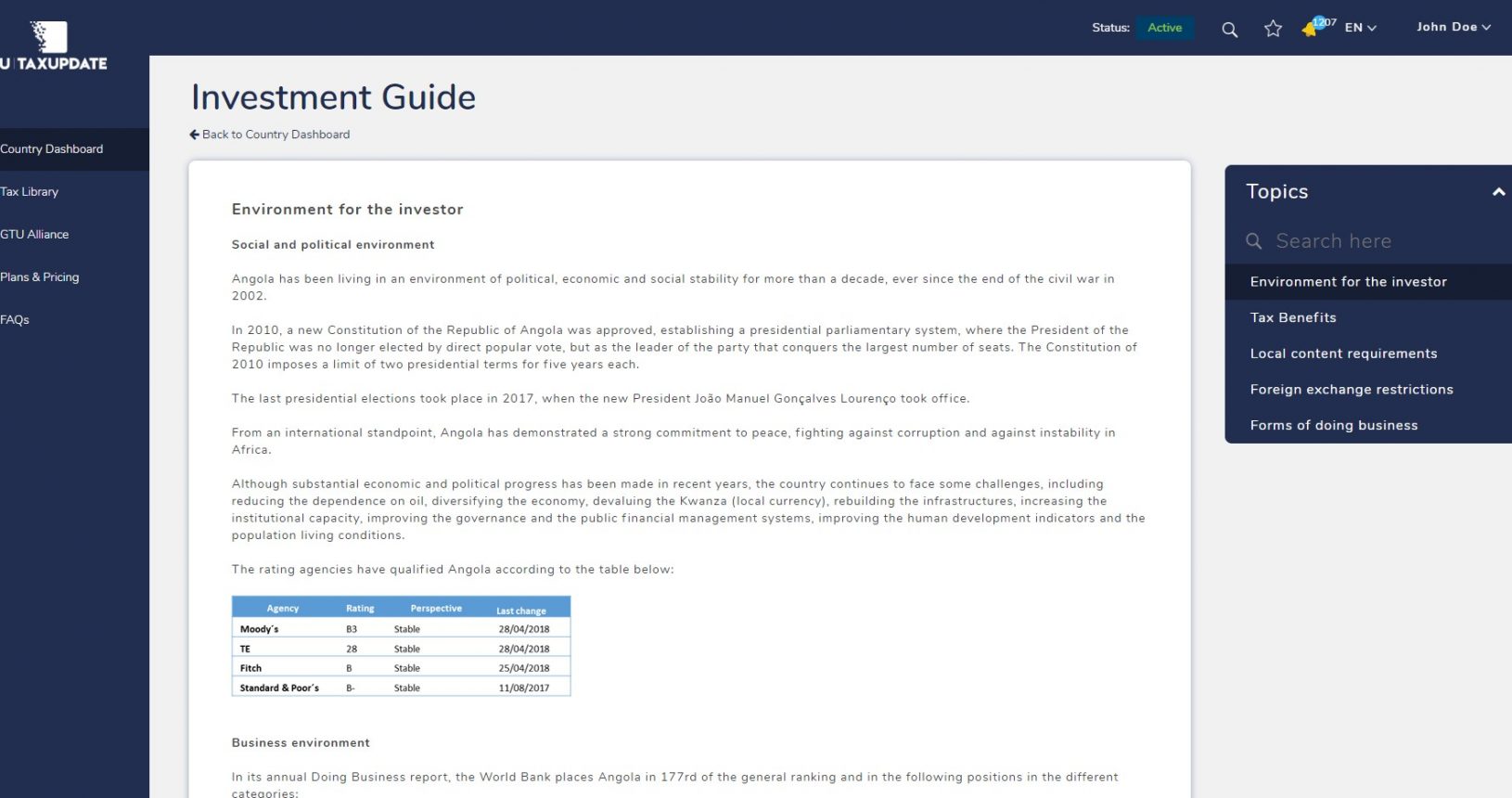

Tax Library and Country Information

Acces to all Features and Functions

Country Guidelines and Business Insights

HOW WE HELP YOU

Our offering was designed to help those who need to understand

market changes and access real-time tax legislation updates.

With GTU you will:

- ✔ Save time sourcing tax information

- ✔ Understand market changes

- ✔ Keep up to date with endless tax changes

- ✔ Reduce costly consultancy hours

- ✔ Save money with time-consuming translations into English

- ✔ Get access to accurate translations with technical vocabulary

- ✔ Make better informed investment decisions

- ✔ Avoid unnecessary tax assessments and liabilities

- ✔ Be in compliance!

AVAILABLE COUNTRIES

Specialists in Taxation for Africa.

Choose a country and start your 3-day free trial today!

GET TO KNOW OUR RELEASEDCOUNTRIES IN FIRST HAND.

GET TO KNOW OUR RELEASEDCOUNTRIES IN FIRST HAND.

Terms and Conditions of Use

Welcome to GTU!

We hope you will find the information on this website helpful and informative. For the protection of all GTU TaxUpdate® visitors we have prepared the following Terms and Conditions of Use (the “Terms”), which together with our Privacy Policy, govern GTU TaxUpdate’s relationship with you, your access and use of all content (the “Content”) at www.globaltaxupdate.com – the “website”. This constitutes a legally binding agreement between you and GTU Legal Research Company S.A.

The use of our Site is conditional on your acceptance of these Terms so when you access and use the GTU website you are agreeing to abide by these Terms.

These Terms of Use are supplemented in all which is not herein provided for, by the Privacy Policy which may be accessed on www.globaltaxupdate.com and which you must expressly accept when registering with us.

1. DEFINITIONS

- “GTU TaxUpdate” or “GTU”: GTU Legal Research Company S.A.;

- “Visitor”: A user who has no registration or subscription and accesses our website;

- “Terms of Use”, “Terms”: means the present document;

- “Site”: is the website provided by GTU TaxUpdate® at www.globaltaxupdate.com;

- “we”, “us”, “our” or “GTU”: means GTU Legal Research Company, S.A.;

- “you” or “your”: means you, the person using our website or Service;

2. ACCEPTANCE OF THE TERMS AND CONDITIONS OF USE

You may only use our website if you agree to these Terms of Use and to our Privacy Policy. If you do not agree with any of the rules set forth in these Terms, you should not use or access the GTU website.

If you continue to browse and use the website you are agreeing to comply with and be bound by the following Terms and conditions of use.

These Terms of Use along with our Privacy Policy will govern your relationship with GTU so it is essential that you carefully read and understand these Terms.

Furthermore, in case you register in the website for any purposes, you agree to provide and maintain true, accurate, current and complete information about you as prompted by the website’s registration form.

If you have any questions or issues regarding these Terms or our Privacy Policy, you may contact us at any time at contact@globaltaxupdate.com.

3. AMENDMENT AND CHANGES TO THE TERMS OF USE

GTU reserves the right to in its sole discretion, amend, modify, update or remove, in whole or in part, at any time, without prior notice and with immediate effect these Terms of Use.

If we amend the Terms of Use, we will post the relevant changes on this page and we will indicate at the bottom of this page the date these terms were last updated.

Your continued use of the website after any such changes constitutes your acceptance of the Terms of Use as amended. If you do not agree to abide by these or any future Terms of Use, you should not use or access (or continue to use or access) the website.

You should review these Terms of Use from time to time to confirm if any updates or changes were made hereto. It is your responsibility to regularly check our Website to determine if there have been changes to these Terms of Use and to review such changes.

From time to time, we will also be sending you certain notifications about GTU, including about amendments to these Terms of Use.

4. USE OF THE WEBSITE

Information. If, for contact purposes, you need to fill in any information, you must provide correct, current, and complete data. If you fail to provide us with accurate and complete data, we may not be able to help you with your request. What we do with the information you provide and how we may use it is governed by our Privacy Policy, which you may find below. You should review and accept the Privacy Policy, which is incorporated as part of these Terms and Conditions of Use.

Newsletters. By registering your information with us, you consent to receiving newsletters from GTU. The aim of our newsletter service is to keep our customers and visitors updated about new features or new information that may be relevant to you. The subscription to our newsletter service is not mandatory. You can unsubscribe from this service at any time by clicking on the resignation link.

5. CONTENT

The website and the Content are made available for general information purposes. The Content and other information available on the website are not intended to and shall not be used as legal or tax advice from GTU. GTU does not provide tax consultancy services, under no circumstances should the scope of these Services be understood as such. You hereby acknowledge to use the Content and information on the website at your own risk. GTU disclaims all liability and responsibility arising from any reliance placed on any Content or information by you.

This website may include content provided by third parties, namely GTU Partners. All statements and/or opinions expressed in these materials, and all articles and responses to questions and other content are solely the opinions and the responsibility of the entity providing them. Under no circumstance will GTU be responsible or liable to you or any third party, for the validity, content or accuracy of any materials provided by any third parties.

If the website contains links to other websites provided by third parties, these links are provided for your convenience only. GTU has no control over those websites and accepts no responsibility for them or for any loss or damage that may arise from your use of them. If you decide to access any of the third-party websites linked to this website, you do so at your own risk and subject to the terms and conditions of use for such websites.

6. INTELECTUAL PROPERTY RIGHTS

The GTU name, logo, trademarks and trade names appearing on the website are trademarks of GTU or its Partners. The content and design of the Site, all materials hosted on the Site and/or distributed with the Site are reserved and property of GTU. You must not copy, reproduce, use or allow anyone to use or reproduce in whole or in part, without our prior written permission from GTU, any trademark or other trade names appearing on our Site or in any content we provide.

Unless with GTU’s prior written consent, any sale, reproduction, distribution, modification, creation of derivative works of, display, republication, download, storage or transmission of any Content is strictly prohibited. If you print, copy, modify, download or otherwise use or provide any other person with access to any part of the website in breach of the Terms and Conditions of Use, your right to use the website will cease immediately and you must return or destroy any copies of the materials you have made.

7. TRADEMARK NOTICES

Reference to any specific commercial products, process, or service by trade name, trademark, manufacturer, or otherwise, does not constitute or imply its endorsement, recommendation, or favoring by GTU. The following trademarks of other companies may appear within our website:

App Store, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries;

Google play is a trademark of Google LLC.

8. PRIVACY AND DATA PROTECTION

Your privacy is the most importance to GTU. You can learn how your information and personal data is handled when you use our Platform by accessing our Privacy Policy below.

9. INDEMNITY

To the extent permitted by law, you agree to indemnify, defend and hold harmless GTU (and each of our affiliates, directors, officers, licensors, employees, stockholders, agents, partners, suppliers or content providers), from and against any claims, demands, complaints, charges, damages, losses, liabilities, costs and expenses (including attorneys’ fees) arising out of (i) your access to or use of the Platform; (ii) any feedback you provide; and (iii) your breach of these Terms and Conditions of Use.

If you are obligated to indemnify us, we will have the right, in our sole discretion, to control any action or proceeding (at our expense) and determine whether we wish to settle it.

10. DISCLAIMER OF WARRANTIES

Use of the website is at your sole risk and you represent and warrant that you have the capacity to agree to these Terms

You undertake that:

- You will fully comply with these Terms;

- You agree that you will use the website at your own risk and acknowledge that the items and any content published or delivered, through our website, may include typographical errors or inaccuracies;

- GTU and our Partners make no representations, and to the fullest extent allowed by law, disclaim all warranties, implied or expressed, including, but not limited to warranties of accuracy, suitability of the information, completeness, timeliness or reliability of any of our content, services, products, links, texts, images, graphics or any items contained or provided by our site or our Services;

- We do not warrant the website’s functionality will be uninterrupted, or free of any errors, bugs or defects;

- We will exercise reasonable skill and care in our provision of our Service, but from time to time, errors may appear, but we will apply reasonable effort to repair them as soon as reasonably practicable.

11. LIMITATION OF LIABILITY

Except as otherwise required by law, in no event, will GTU, our directors, employees, agents, partners, suppliers or content providers be liable under contract, tort, strict liability, negligence or any other legal or equitable theory with respect to the subject matter of these Terms and Conditions of Use for any lost profits, lost revenues, loss of reputation, data loss. The foregoing exclusions shall not apply to gross negligence or willful misconduct.

Our Content and Use are made available and provided for general information and use and are not intended for trading purposes. GTU does not endorse or represent the reliability or accuracy of any advice, comment, translation, statement, text or any information provided. Reliance upon any such opinion, text, comment, advice or any information, shall be at your own risk. The Content does not constitute any form of advice or recommendation provided by GTU or any of our Partners, and is not intended to be relied, or in any way used, in making (or refraining from making) any specific investment, business or any other kind of decision.

GTU, our employees, affiliates, subsidiaries, successors, suppliers or Partners will not be liable to you indirectly or directly for: (i) any damage, loss, cost or expense suffered by you as a result of any spamming, hacking, viruses, worms “Trojan horses” or similar technology, denial of service attack; (ii) any inaccuracy, omission, error, delay or failure in a Site or Service caused by your own computer, device or system; (iii) any inaccuracies or errors that the Site or Service may have; (iv) any incidental, punitive, special or consequential damage, loss or expenses including, but not limited to revenue, contracts, profits, security breach, business interruption or any damage on reputation, goodwill or other pecuniary damages or any other losses you should suffer; (v) any delays, interruptions in the transmission, availability r delivery of the Service or of our Site content; (vi) any loss or damage arising as consequence of any non-performance from our part.

If you incur any loss or damage arising out of your use of our website, you agree that GTU’s liability to you or company shall be limited to €100,00 (one hundred euros or the equivalent in your local currency).

12. TERMINATION

The use and access to our website is not subject to any time limits. As a visitor, you may terminate these Terms by simply discontinuing the use of our Site.

If you breach any of the established provisions, we will have the right to terminate these Terms and use of the Site and Services, at any time by e-mail and without any previous notice.

The Termination to these Terms shall not affect our accrued rights or any obligation, arisen before the date of termination, including, but not limited to, the payment of any sums outstanding under these Terms at the date of termination.

13. VALIDITY OF THE TERMS AND CONDITIONS OF USE

If any section, term or provision of these Terms and Conditions of Use is held invalid or unenforceable by a competent court of the country you live in, such invalidity shall not affect the validity or operation of any other section, term or provision, and such section, term or provision shall be deemed to be severed from the agreement.

14. FORCE MAJEURE

GTU shall not be deemed to be in breach of the Terms if the delay or failure, of any kind, to provide the Service or Site, was due to any cause beyond our reasonable control, including, but not limited to, acts of God, explosions, floods, fire or accidents, war or terrorism, civil disturbance, epidemics, prohibitions or measures of any kind on the part of any governmental or local authority, import or export regulation or embargos or trade disputes.

15. QUESTIONS

We are always open to receive your feedback and comments about GTU and the Content. In case you have any questions concerning these Terms of Service, you should send us request for information through the website’s contact form or to contact@globaltaxupdate.com. Any communication made by GTU will be sent to the email address which has been submitted in said form. The communications sent by email are deemed to have been received on the day they are sent.

16. GOVERNING LAW AND JURISDICTION

These Terms of Use shall be governed by and construed in accordance with the laws of Portugal. Any disputes arising from these Terms and Conditions of Use shall be settled by the courts of Lisbon, Portugal, with express waiver of any other, to the maximum extent permitted by the applicable law.

17. GENERAL

These Terms of Use constitute the entire agreement between you and GTU with respect to the website and the content available through the website. The company responsible for the Content and the website is GTU Legal Research Company, S.A. which is located and registered in Portugal at Avenida Marginal, Edifício Parque Oceano 3.ºC, 2780-322, Santo Amaro de Oeiras, Oeiras – Portugal, holder of taxpayer and company number 514797878.

Last updated on April 2020

Privacy Policy and Cookies Policy

GTU TaxUpdate® is a website owned by GTU Legal Research Company, S,A., a company with registered address at Avenida Marginal, Edifício Parque Oceano 3.ºC, 2780-322, Santo Amaro de Oeiras, Oeiras – Portugal and with taxpayer and company number 514797878 (hereinafter referred to as “GTU”, “we” or “us”).

When you use the GTU website, you will share some information with us.

So, we want to be open about the information we collect, how we use it, whom we share it with, and the choices we give you to control, access, and update your information.

That is why we have prepared this Privacy and Cookies Policy, which describes the terms, conditions and rules applicable to the personal data processing carried out by GTU.

At GTU, we understand the importance of protecting your personal information and we are committed to safeguarding your privacy online. This Policy describes the types of information GTU may collect from you or that you may provide when you visit our website and our practices for collecting, using, maintaining, protecting, and disclosing that information.

This policy applies only to information we collect:

- When you visit our website – www.globaltaxupdate.com.

- In chat, text, email, or other electronic messages between you and GTU – for example, when you register or subscribe to a certain plan, create a profile, or use an interactive feature.

- Through mobile and desktop applications you download from the mentioned website, which provide dedicated non-browser-based interaction between you and GTU.

Please carefully read this document as you acknowledge that it is part of our Terms and Conditions of Use, and by clicking “I agree” to those Terms and Conditions you agree to be bound and abide by it. If you do not agree, you must not access the website or use any of the content found on it.

If, after reading our Privacy Policy, you still have questions about anything herein, please feel free to contact us at contact@globaltaxupdate.com.

1. INFORMATION COLLECTED

When you fill in the fields for contact purposes or use the GTU website we will receive and retain personal information about you (“Data Subject”). For this purpose, we will be considered as Data Controllers for the treatment of Personal Data collected and treated in each of the situations referred below. The kind and amount of information depends on how you use the website.

Our website is not intended for children under 13 years of age and is not targeted toward children. We do not knowingly collect personal information from children under 13.

Non-Personal Information and Aggregated Information. This information does not identify a specific individual by itself.

When you browse and interact with our website, we may automatically collect certain information about your device, browsing patterns and actions, including location data, logs, traffic data, or other communication data and the resources that you access and use on the website, as well as information about your computer and internet connection, including your IP address, operating system, and browser type.

This information collected automatically will not be used in order to identify a user, is statistical data and is usually aggregated with other information to help us improve our website.

Personal Data. identifiable information – your “Personal Data”- gives us details about who you are, such as your name, your email address, your postal address, and your phone number.

When you fill in one of our contact forms through our website, we will ask for certain information about you such as your first and last name, address and company name.

We collect Personal Data directly from you when you provide it to us, as in the following situations:

- We may ask you for information when you report a problem with our website.

- If you contact us, we will keep records and copies of your correspondence (including email addresses).

- When you carry out transactions through our website, we will keep track of that. At those times, you will also be required to provide financial information, such as credit card information and other billing information. This information will only be shared with third parties who help to complete the purchase transaction.

In any of the above-mentioned situations, GTU assumes that the Personal Data was submitted by the respective Data Subject or that its submission was authorized by the same. GTU further assumes that the data is real, accurate and up to date. The Data Subject is responsible for the personal data transmitted and submitted to GTU.

2. PROCESSING AND USE OF PERSONAL DATA

GTU uses information that we collect about you or that you provide to us, including any Personal Data for the following purposes:

- present our website and its contents to you.

- provide you with information, or services that you request from us.

- fulfill any other purpose for which you provide it.

- provide notices about your account or subscription, including expiration and renewal notices.

- comply with our obligations and enforce our rights arising from any contracts entered between you and GTU, including for billing and collection.

- notify you of changes to our Site or any products or services we offer or provide through it.

We also use this information to customize certain website features to provide you with an enhanced experience based on the type of device you are using to access the website, and in certain cases, to provide you the requested content.

3. HOW WE USE YOUR INFORMATION

We use information we collect about you or you provide us for several purposes, including:

- Present our website and its contents to you.

- Provide you with information or products which you may ask from us.

- Provide you with notices about your subscription, such as expiration and renewal notices.

- Notify you about changes to our website or any products we may offer.

- Allow you to participate in interactive features on our website – forum or chat.

- Customize certain features of the website to provide you with an enhanced experience based on the type of device you are using. Contact you about products and services provided by GTU and that may be of interest to you

In any other way we may describe, and you may specifically consent to, when you provide the information.

4. DISCLOSURE OF PERSONAL DATA TO THIRD PARTIES

For the purposes above GTU may disclose Users’ personal data:

- To Data Processors in order to process the data under GTU’s instructions and on its behalf (including IT developers and maintenance service providers, IT providers, and GTU partners) to ensure that such data processors provide sufficient guarantees on the implementation of measures that ensure processing will meet the requirements of the applicable law and ensure the protection of the rights of the users;

- To fulfill the purpose for which you provide it;

- To third parties and entities when GTU deems it necessary or appropriate: under applicable law; to comply with legal processes; to respond to requests from public and government authorities;

- To third parties in case of any given restructuring of the company (GTU Legal Research Company, S.A.), merger, sales, joint venture, transfer or any acquisition of the totality or part of its business, assets or shares;

- To other companies in the group, or companies whose partners are GTU partners, and conduct any GTU related or equal activity.

We may need to transfer your information internationally to other companies or service providers. This data transfer may happen if our servers (i.e. where we store data) or our service providers are based outside the country where we offer our services. When any of the above occurs, we will make sure that it is done in compliance with the legislation in force, and your information is properly. GTU will take all applicable measures to protect its Users’ personal data, as well as requires that these third parties comply with all the measures required by the Law and Data Protection Regulation, namely technical measures and organizational structures.

5. USERS’ RIGHTS

GTU respects your rights in accordance with the applicable data protection law. As such, you have the rights to:

- access personal data: to understand whether or not we are processing your personal data and when we are, to request a copy of the personal data that GTU holds about you;

- correct personal data: you have the right to request us to correct any inaccurate information;

- erasure: in certain circumstances you may have the right to ask us to erase any personal data we hold about you. We only process and retain your data for as long as we need to;

- restrict processing: in some circumstances such as in the case of inaccurate data or unlawful processing you have the right to restrict the processing that we carry out with your personal data;

- data portability: the right to be able to take data you provided to GTU in certain circumstances provided it shall not adversely affect the rights and freedoms of others;

- object: the right to in certain circumstances object to GTU processing your personal information. You may withdraw the consent to process their data at any time. However, this does not affect any processing performed by that date based on any consent previously provided. If for any reason you want to delete your account, you can do so on the site.

You may exercise any of the rights by entering the site or by written request addressed to contact@globaltaxupdate.com.

6. STORAGE OF PERSONAL DATA

The Personal Data processed by GTU shall only be stored for the necessary period and for the purposes aforesaid. After this period, such data shall be permanently erased, unless there is a legal obligation or in case the GTU adopts some of the technical measures that allow the retention of data in total security, such as anonymization or pseudonymisation.

7. DATA RETENTION

GTU shall retain Personal Data for as long as the user account is active for services to be provided or as long as GTU requires that its Personal Data comply with the purposes for which it was originally collected, unless required by law.

We will retain and use the information as necessary to comply with our legal obligations, resolve disputes, and enforce our agreements.

Where there is no specific legal requirement, the data shall be stored and stored only for the minimum period necessary for the purposes for which it was collected or for further processing or,, if and when applicable, for the period determined by the competent data protection authorities, after which it will be deleted.

8. DATA SECURITY

GTU is committed to ensuring the safety of your personal data, from collection to deletion or anonymization. As such, GTU has implemented appropriate technical and organizational measures to ensure an adequate level of security for this risk.

However, no one can guarantee the complete security of your information. The safety and security of your Personal Data also depends on you. In cases where we have given you (or where you have chosen) a password for access to certain parts of our website, you are responsible for keeping this password confidential. We ask that you do not share your password with anyone. Unfortunately, the transmission of information over the internet is not entirely secure. While we strive to protect your personal information, we cannot guarantee the security of your personal information transmitted to our site. Any transmission of personal information is at your own risk and we are not responsible for circumvention of any privacy settings or security measures contained on the website.

9. COOKIES AND OTHER TECHNOLGIES

Cookies are text files which are stored in your browser or hard drive of your device when you visit a website. They are used by most websites to improve your experience browsing the site.

The information processed regards the users’ browsing preferences, such as the way users access and use the GTU website and in which country area they access it and they do not include any information or personal data regarding the users – only generic information.

How to change Cookies preferences. Within your browser you can choose whether you wish to accept Cookies or not. Generally, your browser will offer you the choice to accept, refuse or delete Cookies or warn when Cookies are being sent. Each browser’s website should contain instructions on how you can do this. Please note that some features on the website will not work if you do not allow Cookies. To learn more about Cookies, please visit the website http://ec.europa.eu/ipg/basics/legal/cookies/index_en.htm, where you can find information on how to manage many internet browsers.

How and why GTU uses Cookies. GTU uses first-party and third-party cookies, in particular we use:

- authentication cookies, to identify the user you have logged in for the duration of a session. These cookies are exempt from consent.

- performance and functionality cookies, these cookies are used to enhance the performance and functionality of our website but are non-essential to their use. However, without these cookies, certain functionality may become unavailable.

- analytics and customization cookies; these cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website for you.

- advertising cookies, these cookies are used to make advertising messages more relevant to you. They perform functions like preventing the same ad from continuously reappearing, ensuring that ads are properly displayed for advertisers, and in some cases selecting advertisements that are based on your interests.

You can enable or disable cookies in your browser, and if you wish you can restrict or block the cookies set by any website. You can do this through the web browser settings for each web browser you use, on each device you use to access the internet. Information on controlling and deleting cookies, including on a wide variety of browsers, is also available at allaboutcookies.org.

We also use Pixels in our websites. A Pixel is a tool that helps us analyze the effectiveness of our services, by tracking the actions of visitors and users.

We will inform and obtain your consent for all tracking we make from your visit.

10. COMPLAINTS

Without prejudice to any other administrative or judicial proceedings, as Data Subject, under the law, you are entitled to lodge a complaint before a Data Protection Authority or any other relevant authority, in case you consider that the processing of your personal data violates the legal framework in force.

11. CONTACT INFORMATION

If you have questions or concerns about how GTU processes your personal data, please send a request for clarification to contact@globaltaxupdate.com.

You may contact GTU for all questions relating to the processing of your personal data and enforcement of the rights granted under applicable legislation and those set out in this Privacy Policy, at contact@globaltaxupdate.com.

12. AMENDMENTS TO THE PRIVACY POLICY AND COOKIES POLICY

GTU may amend its Privacy Policy and Cookies Policy at any time. The updated version of the Privacy and Cookie Policy that reflects these changes must be posted to the website and, if appropriate, sent directly to you.

Last updated on April 2020

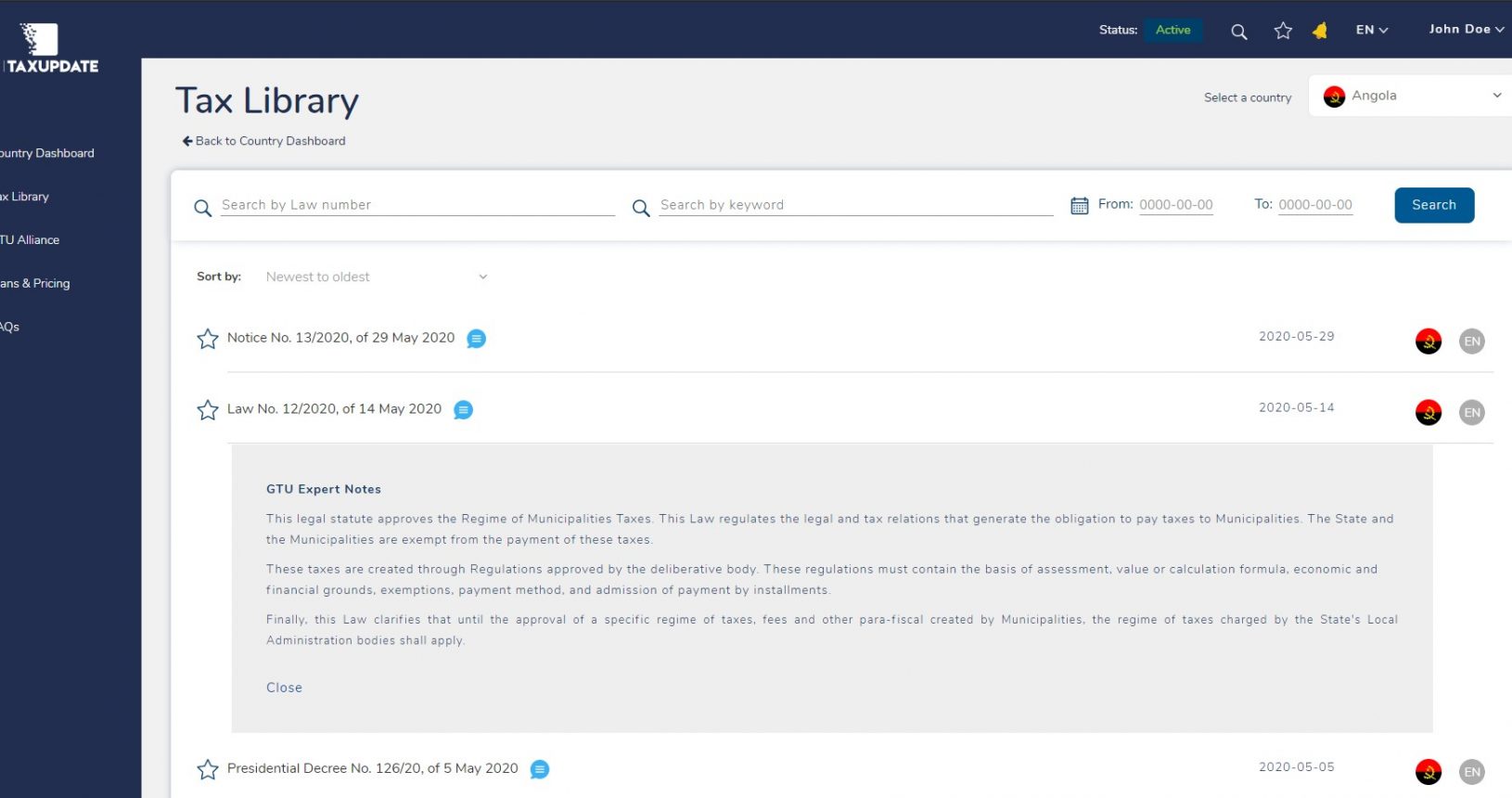

OUR FEATURES

Have access to neatly organized tax information and country guidelines for Africa.

Start your 3-day free trial today!

No credit card or commitment required.OUR PLATFORM

Check our features and functionalities. Start your 3-day free-trial today!

GTU ON THE MEDIA

FREQUENTLY ASKED QUESTIONS, ANSWERED.

Have questions? We're here to help.

• 3-day trial period, no obligation or commitment;

• Access to Portugal and all African Countries within the platform;

• Acess to Tax Library with 5 legal statutes available in the local language, with the main one translates into English;

• 4 unlocked country insights: Country Snapshot, Investment Guide, Main Taxes & Penalties and Tax Guide.

• Technical support from 9am to 6pm (Lisbon Time Zone), from Mon-Fri via +351 215 900 800.

You can also choose to pay via International Bank Transfer. In this case, we will send you a Proforma Invoice.

E-mail: contact@globaltaxupdate.com

Telephone: +351 215 900 800 (Mon-Fri, from 9am to 6pm, Lisbon Time Zone)

For sales contact, please send an email to sales@globaltaxupdate.com