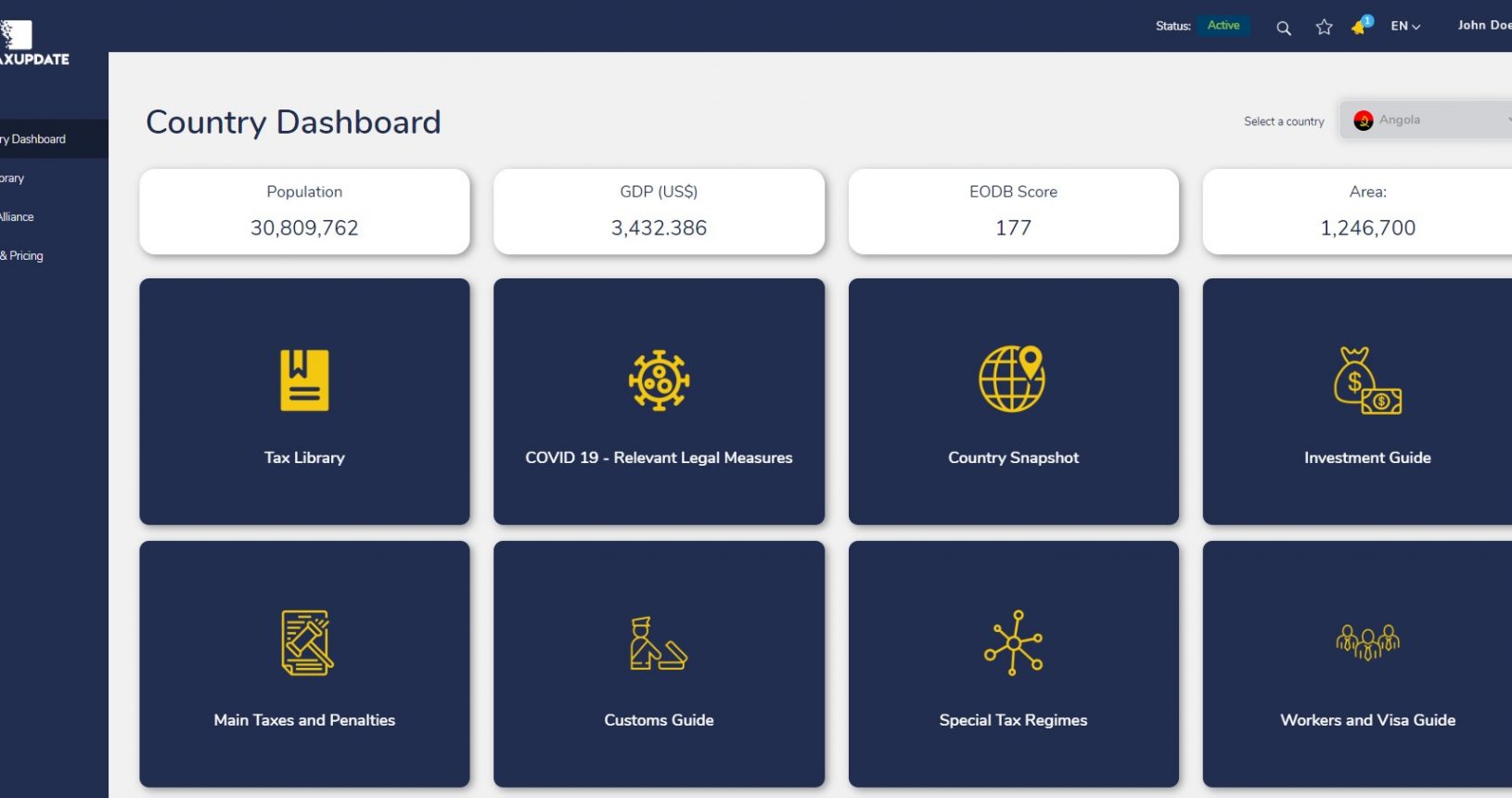

HOW IT WORKS

We cover complex tax markets to provide you with real-time tax legislation updates, country guidelines and other business essentials when negotiating in Africa.

OUR OFFER

STARTING FROM €20 PER MONTH

Make the perfect choice for you! We have 4 options of plans, with 1, 6 or 12-month billing alternatives.

Include add-ons according to your preference.

Acces up to 9 countries

Choose number of Users

Receive Daily Tax Updates via email

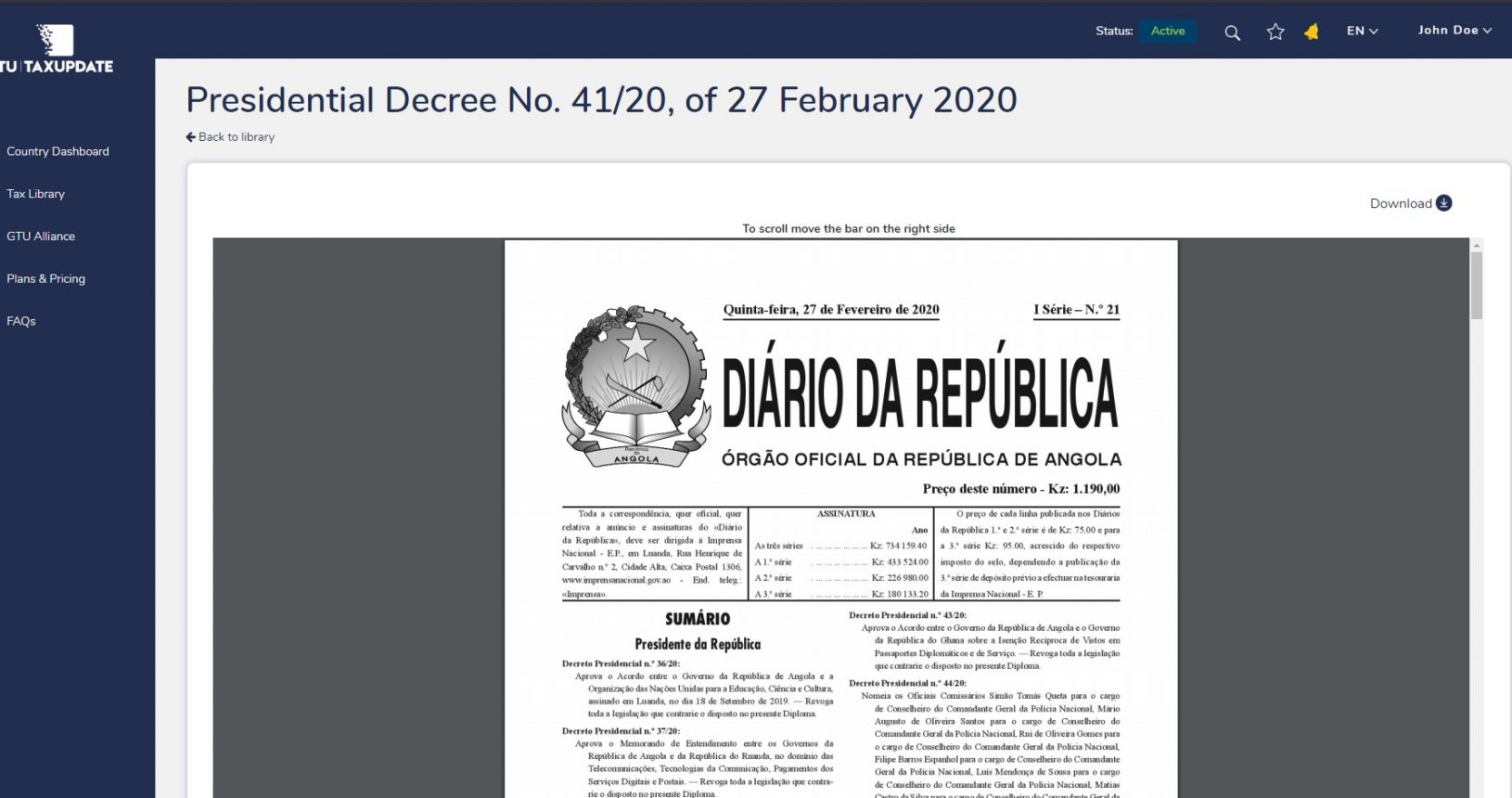

Access Documents from Original Sources

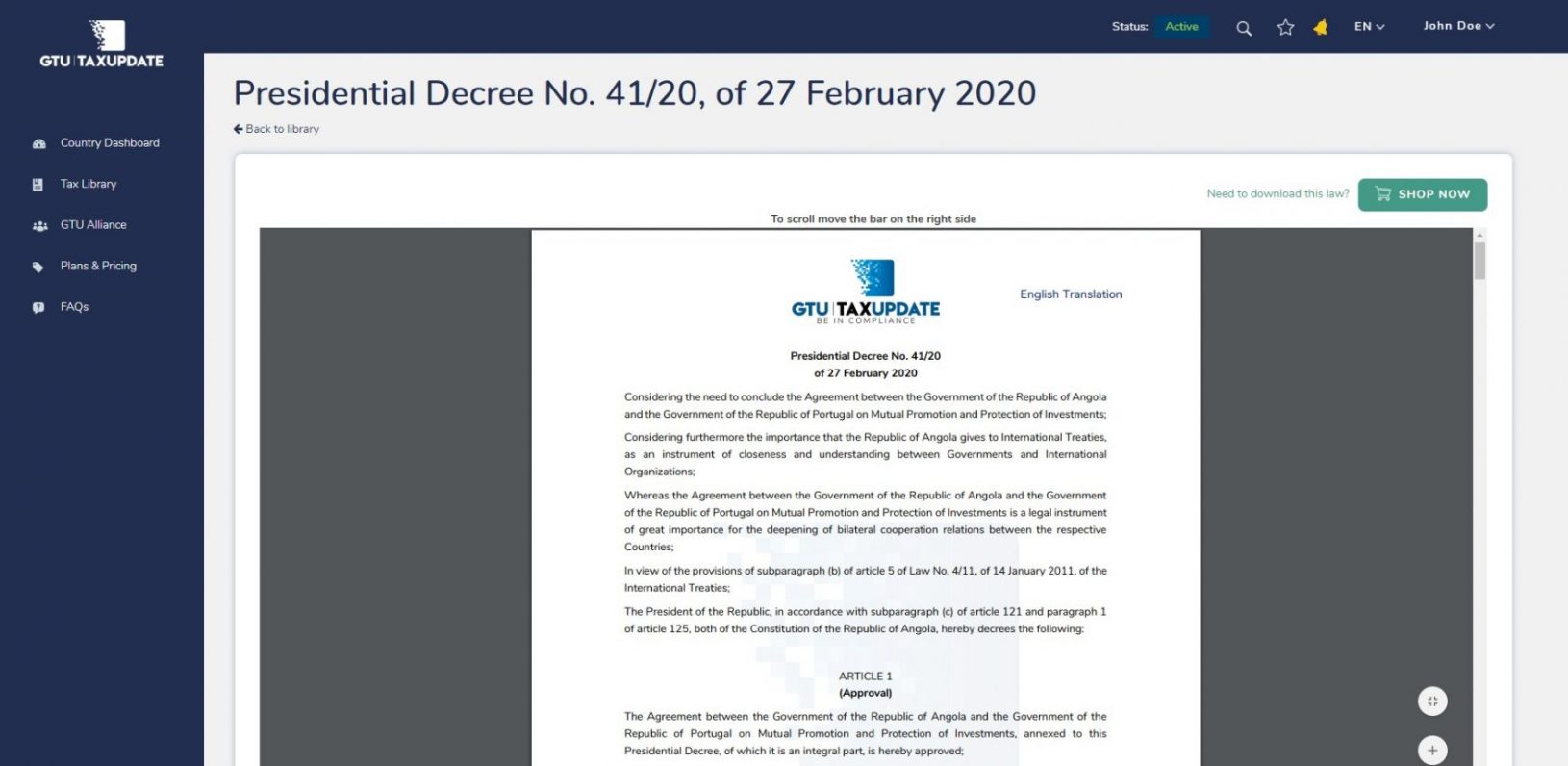

English Translation of Main Legal Statutes

Dowload Original Documents

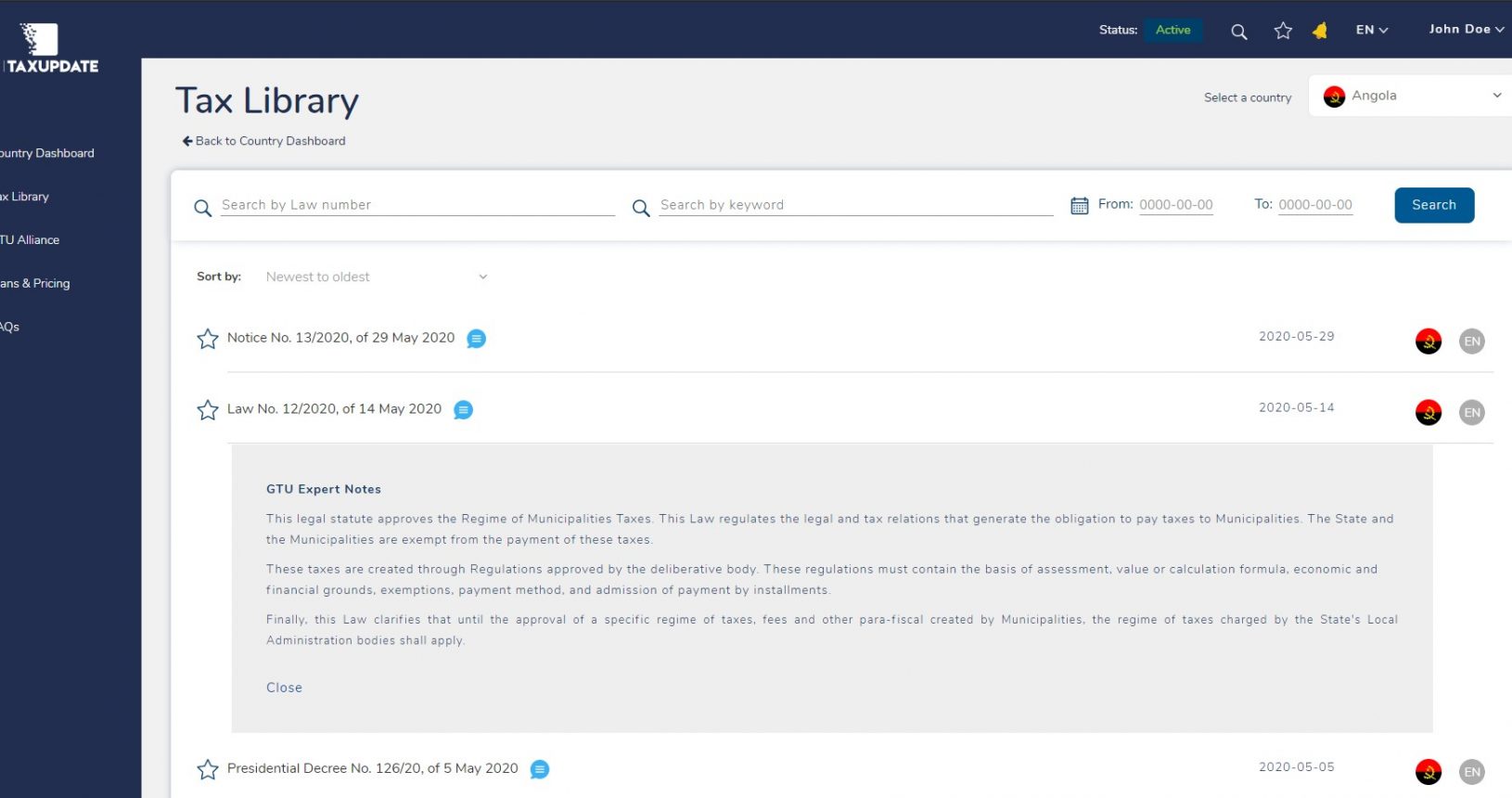

Tax Library and Country Information

Acces to all Features and Functions

Country Guidelines and Business Insights

HOW WE HELP YOU

Our offering was designed to help those who need to understand

market changes and access real-time tax legislation updates.

With GTU you will:

- ✔ Save time sourcing tax information

- ✔ Understand market changes

- ✔ Keep up to date with endless tax changes

- ✔ Reduce costly consultancy hours

- ✔ Save money with time-consuming translations into English

- ✔ Get access to accurate translations with technical vocabulary

- ✔ Make better informed investment decisions

- ✔ Avoid unnecessary tax assessments and liabilities

- ✔ Be in compliance!

AVAILABLE COUNTRIES

Specialists in Taxation for Africa.

Choose a country and start your 3-day free trial today!

OUR FEATURES

Have access to neatly organized tax information and country guidelines for Africa.

Start your 3-day free trial today!

No credit card or commitment required.OUR PLATFORM

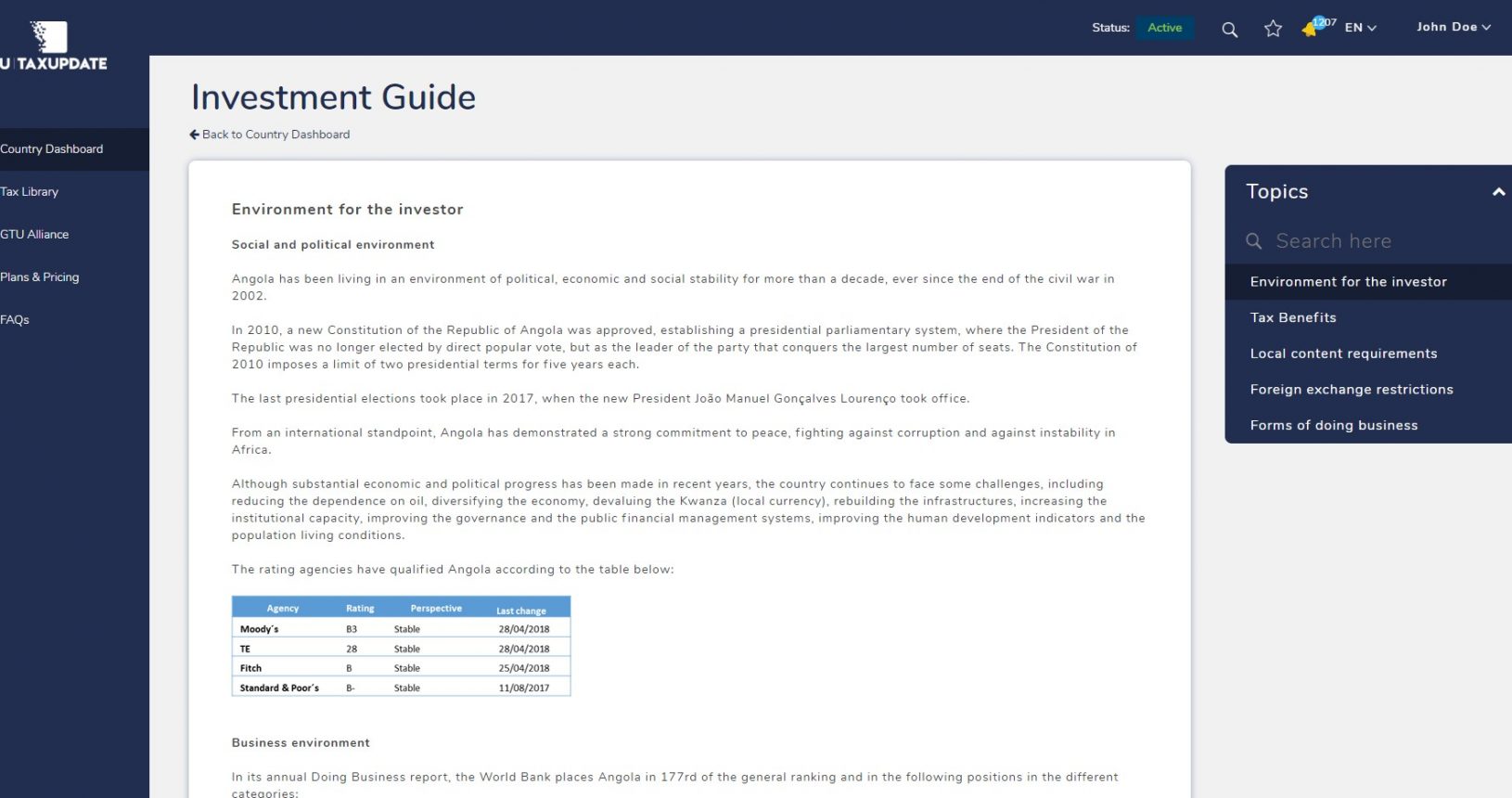

Check our features and functionalities. Start your 3-day free-trial today!

GTU ON THE MEDIA

FREQUENTLY ASKED QUESTIONS, ANSWERED.

Have questions? We're here to help.

1How does the free trial work?

We allow you to test our tax library with no strings attached. All you need to do is simply register and choose a country for your free trial activation. You will receive an email with the confirmation and will be ready to start.

2What’s included in my trial period?

Your free trial includes:

• 3-day trial period, no obligation or commitment;

• Access to Portugal and all African Countries within the platform;

• Acess to Tax Library with 5 legal statutes available in the local language, with the main one translates into English;

• 4 unlocked country insights: Country Snapshot, Investment Guide, Main Taxes & Penalties and Tax Guide.

• Technical support from 9am to 6pm (Lisbon Time Zone), from Mon-Fri via +351 215 900 800.

• 3-day trial period, no obligation or commitment;

• Access to Portugal and all African Countries within the platform;

• Acess to Tax Library with 5 legal statutes available in the local language, with the main one translates into English;

• 4 unlocked country insights: Country Snapshot, Investment Guide, Main Taxes & Penalties and Tax Guide.

• Technical support from 9am to 6pm (Lisbon Time Zone), from Mon-Fri via +351 215 900 800.

3Do I need to enter my credit card info to register?

You do not need to provide your credit card details in order to register, or during a free trial. We will only request your card information when you decide to subscribe to a plan.

4How can I subscribe?

Registration is quick and easy, you can sign-up at http://app.globaltaxupdate.com/register. Once you're logged in, scroll down or click on Menu's yellow button "Subscribe now" to see our plans. If you you require help with this process please contact us via email at sales@globaltaxupdate.com and we will be happy to help.

5What payment methods do you accept?

We accept Visa, Mastercard and American Express credit and debit cards trhough PayPal. We will only request this information once you are ready to subscribe to a plan.

You can also choose to pay via International Bank Transfer. In this case, we will send you a Proforma Invoice.

You can also choose to pay via International Bank Transfer. In this case, we will send you a Proforma Invoice.

6 How can I contact you if I need to get in touch?

We are available via the following contacts:

E-mail: contact@globaltaxupdate.com

Telephone: +351 215 900 800 (Mon-Fri, from 9am to 6pm, Lisbon Time Zone)

For sales contact, please send an email to sales@globaltaxupdate.com

E-mail: contact@globaltaxupdate.com

Telephone: +351 215 900 800 (Mon-Fri, from 9am to 6pm, Lisbon Time Zone)

For sales contact, please send an email to sales@globaltaxupdate.com

![shutterstock_391245895-[Converted]](https://globaltaxupdate.com/wp-content/uploads/2020/04/shutterstock_391245895-Converted.png)